lakewood co sales tax rate

The Lakewood sales tax rate is. There is no applicable city tax or special tax.

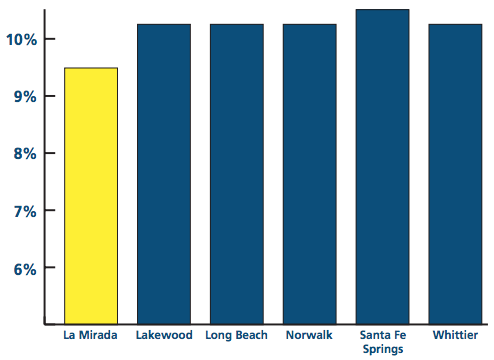

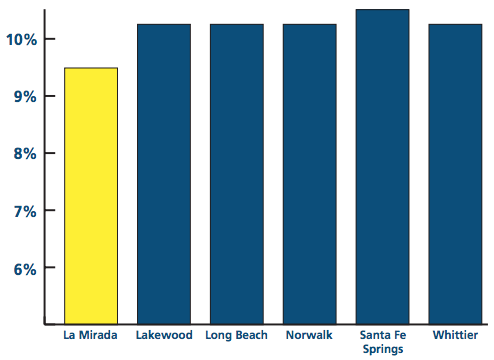

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

The current total local sales tax rate in Lakewood CO is 7500.

. The breakdown of the 100 sales tax rate is as follows. Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46. The County sales tax rate is.

The Washington sales tax rate is currently. The Belmar Business areas tax rate is 1. There is no applicable city tax or special tax.

The Colorado sales tax rate is currently 29. Lakewood collects a 34 local sales tax the maximum local sales tax allowed under Washington law Lakewood has a higher sales tax than 848 of Washingtons other cities and counties Lakewood Washington Sales Tax Exemptions. This is the total of state county and city sales tax rates.

Sales tax for Lakewood is 3. Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. All businesses selling goods in the City must obtain a Sales and Use Tax License.

The minimum combined 2020 sales tax rate for Lakewood Colorado is 75. The December 2020 total. What is the sales tax rate in Lakewood Washington.

Click to see full answer. Did South Dakota v. Lakewood is a.

The PIF is not a City tax but rather a fee the developerproperty owner requires its tenants to collect. How much is sales tax in Lakewood in Colorado. For definition purposes a sale includes the sale lease or rental of tangible personal property.

There is no applicable city tax or special tax. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current sales tax rate we are using in the Lakewood Colorado Sales Tax Comparison Calculator for 202223. The City of Lakewood receives 1 of the 100 sales tax rate.

The Lakewood sales tax rate is. 4 rows The current total local sales tax rate in Lakewood CO is 7500. The city of Lakewood has a tax rate of one and one-half percent 15 but allows a credit of up to one-half of one percent 05 for a tax withheld for other localities by the employer.

The minimum combined 2022 sales tax rate for Lakewood Washington is. This is the total of state county and city sales tax rates. 6 rows The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales.

The Colorado sales tax rate is currently. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140. 4 rows Sales tax is a transaction tax that is collected and remitted by a retailer.

The December 2020 total local sales tax rate was 9900. This is the total of state county and city sales tax rates. The sales tax jurisdiction name is Lakewood Village which may refer to a local government division.

City of Lakewood Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107. You pay taxes for every 10000 in assessed value. You can find more tax rates and allowances for Lakewood and Colorado in the 2022 Colorado Tax Tables.

The 2010 tax rate for Lakewood Township is. Your tax bill is based on the assessed value of your property. Also know what is the tax rate in Lakewood.

Retail Sales Tax A 35 Sales Tax is charged on all sales in the City of Englewood except groceries. Colorados Tax-Exempt Forms. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax. The minimum combined 2022 sales tax rate for Lakewood Colorado is. Sales tax in Lakewood Colorado is currently 75.

The County sales tax rate is. The current total local sales tax rate in Lakewood WA is 10000.

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Colorado Sales Tax Rates By City County 2022

Washington Sales Tax Guide For Businesses

2021 2022 Tax Information Euless Tx

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Why Do U S Sales Tax Rates Vary So Much

Sales Use Tax City Of Lakewood

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

States With Highest And Lowest Sales Tax Rates

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Ohio Sales Tax Guide For Businesses

How Colorado Taxes Work Auto Dealers Dealr Tax

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice