franklin county ohio sales tax rate 2020

32312 manufactured homes ORC. Ohio is ranked 863rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Sales Taxes In The United States Wikiwand

In Portland the largest city in the county as well as the state the 2020 tax rate is 2331 mills.

. Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. A full screen option for this dashboard can be found on the lower right corner. As such the Columbus Division of Income Tax will not grant refund requests for withholding paid to Columbus during tax year 2020 in accordance with CCC.

Front Street 2nd Floor. Real Estate Tax Information. The median property tax in Richland County Ohio is 1423 per year for a home worth the median value of 112200.

614 645-7193 Customer Service Hours. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax. Due to the COVID-19 pandemic the Division is currently closed to the public.

Furthermore for tax year 2020 this provision applies to both an employers tax withholding obligations and an employees actual tax liability. Franklin County is located in central Ohio and contains the state capital Columbus. Report on the prevalence of current and past COVID-19 in Ohio adults.

Taxpayers may use the secure drop box located in the lobby of the 77 N. The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes.

As of Monday March 14 the Ohio Department of Health has transitioned to reporting COVID-19 metrics from a daily to weekly cadence. 362011 and Ohio HB. The Reynoldsburg income tax rate is 25 with 100 credit up to 25 for taxes paid to the workplace municipality.

Since the income tax is mandatory all residents are required to file an annual city income tax return or in some cases an exemption. 197 section 29 as. Monday through Friday 900 am.

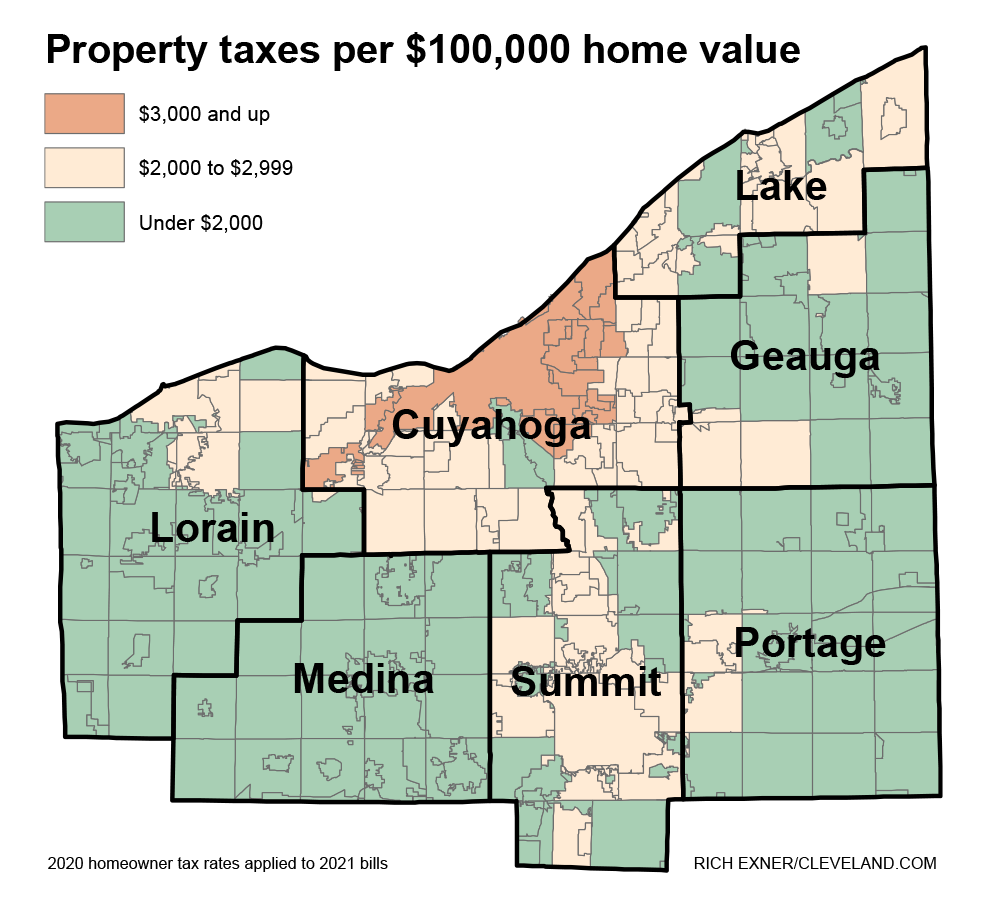

Since Portland assesses property at 100 of market value that implies a tax rate of about 233 for real estate owners in the city. On average the county has the third-highest property tax rate in Ohio with an average effective rate of 205. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848.

The last countywide reappraisal in Franklin County was in 2017. Taxes on real estate are due in January and June of each year. In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes.

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. And taxes on manufactured homes are due in. New York has 2158 special sales tax.

Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax. The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a. City of Columbus Income Tax Division 77 N.

450306 and personal property ORC. To exit full screen mode press the Esc key. Richland County collects on average 127 of a propertys assessed fair market value as property tax.

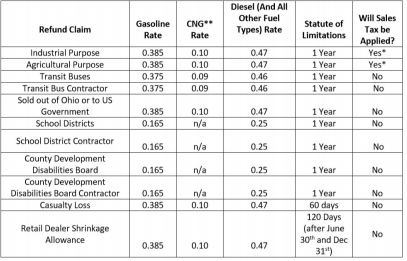

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

State Local Property Tax Collections Per Capita Tax Foundation

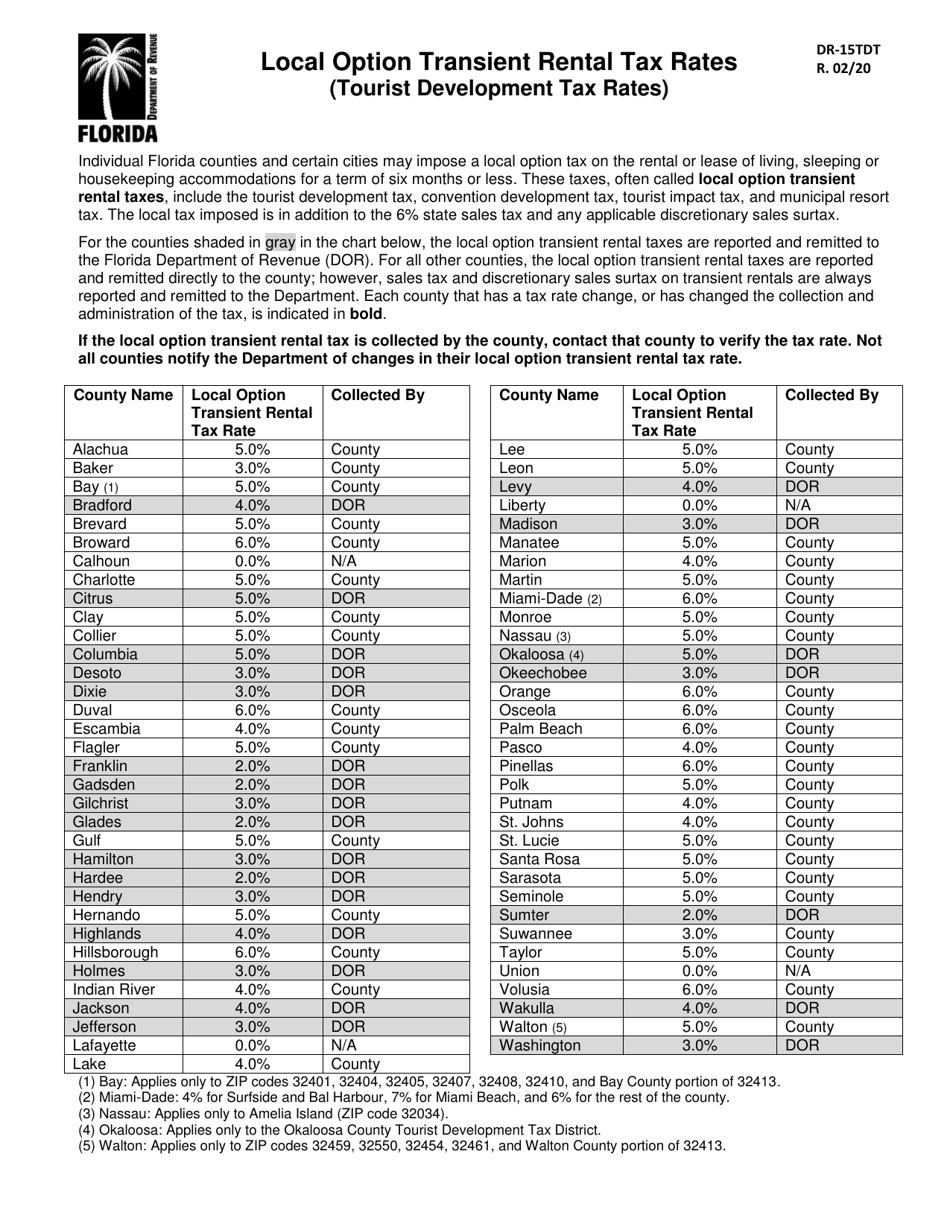

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller

Tennessee Sales Tax Small Business Guide Truic

Key Gop Senator Proposes Brief Summer Reprieve From Sales Tax Indianapolis Business Journal

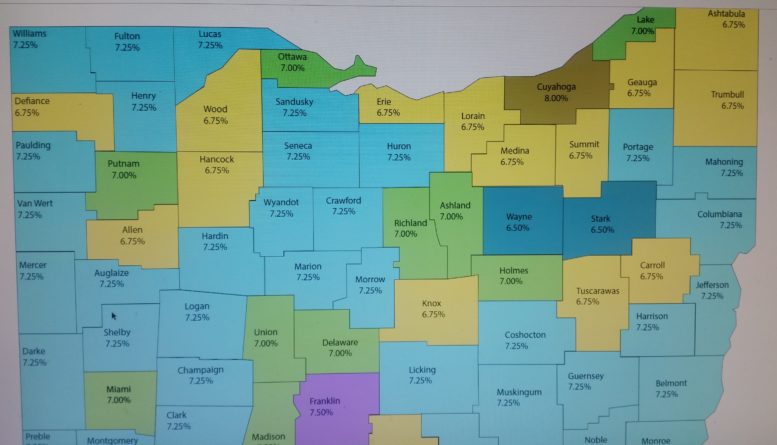

Ohio Sales Tax Rates By City County 2022

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Kansas Sales Tax Rates By City County 2022

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Florida Sales Tax Rates By City County 2022

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

How Does Texas Meet Its Fiscal Responsibilities Without A State Income Tax Quora

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Washington Sales Tax Guide For Businesses

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction